Technology fund leads returns

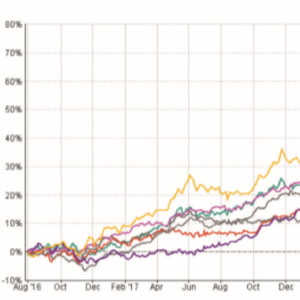

A technology focused superannuation fund is the only fund across 14 sectors that has made an annualised return above 20 per cent over the three years to 31 July 2019, according to data.

According to FE/Fundinfo data, Commonwealth Select Personal Superannuation Colonial First State Wholesale Global Technology and Communications fund made an annualised return of 21.5 per cent over the three years to 31 July 2019.

In cumulative terms, the fund returned 79.5 per cent over the same time period. This was compared to its global equity super sector average that returned 37.5 per cent.

The global equity sector average also performed the best compared to the other superannuation equity sectors.

Emerging markets returned 33.6 per cent, global hedged at 31.5 per cent, Australian equities at 29.88 per cent, Australian small and mid-cap equities at 27.6 per cent, and infrastructure equities at 23.9 per cent.

Despite the technology sector copping volatility largely thanks to various privacy breaches, the CFS fund has managed to weather these issues.

Looking at the fund’s allocation, it is interesting to note that only three out of the highly sought after ‘Faang’ stocks have made it into their top 10 holdings.

Of the Faang – Facebook, Amazon, Alphabet, Netflix, and Google – stocks only Facebook (at 5.31 per cent weighting), Amazon (5.26 per cent) and Netflix (2.8 per cent) made the list.

They were joined by Microsoft (6.3 per cent), Marvell Technology Group (six per cent), Harris Corp (3.5 per cent), Global Payments (3.5 per cent), Advanced Micro Devices (3.06 per cent), Workday (2.87 per cent), and Flex (2.62 per cent).

Unsurprisingly, 88 per cent of the fund’s geographic allocation was to North America, followed by Asia at 5.95 per cent, Europe at 4.2 per cent, Japan at 1.67 per cent, and the UK at 0.17 per cent.

However, according to Bank of America Merrill Lynch’s latest global fund manager survey, long US technology stocks were the second most crowded trade, following long US treasuries.

Technology was also the top sector in which fund managers said were overweight. This was followed by pharmacy, discretionary, and staples, the survey found.

While the fund has performed well, it has only received two Crown ratings (out of five) as a result of the fund’s volatility compared to its peers.

The fund has a volatility of 14.25, compared to its sector that has a volatility of 8.03.

FE’s Crown ratings are a risk adjusted quantitative rating.

Recommended for you

From government consultations to ASIC reviews, Super Review has put together a timeline of how super funds’ handling of member complaints has grown in prominence in the last 12 months.

Speaking to Super Review, Christina Hobbs shares why the superannuation industry needs to better service female members and how Verve Super implements an ethical investment approach.

Multiple super funds are in the process of recruiting a new chief executive as consolidation causes a dramatic decline in the number of C-suite roles.

In an interview with Super Review, Vision Super chief executive Stephen Rowe has shared his thoughts on the Active Super merger and the challenge of keeping up with ever-changing regulation.

Add new comment